July 8, 2025

Banco BPM launches AI-driven transaction enrichment in collaboration with Snowdrop

Milan, Italy / London, United Kingdom – 8 July 2025.

Banco BPM, one of Italy’s leading banking groups, has introduced enriched transaction details within its mobile app, powered by Snowdrop Solutions’ enrichment API (known as the MRS API).

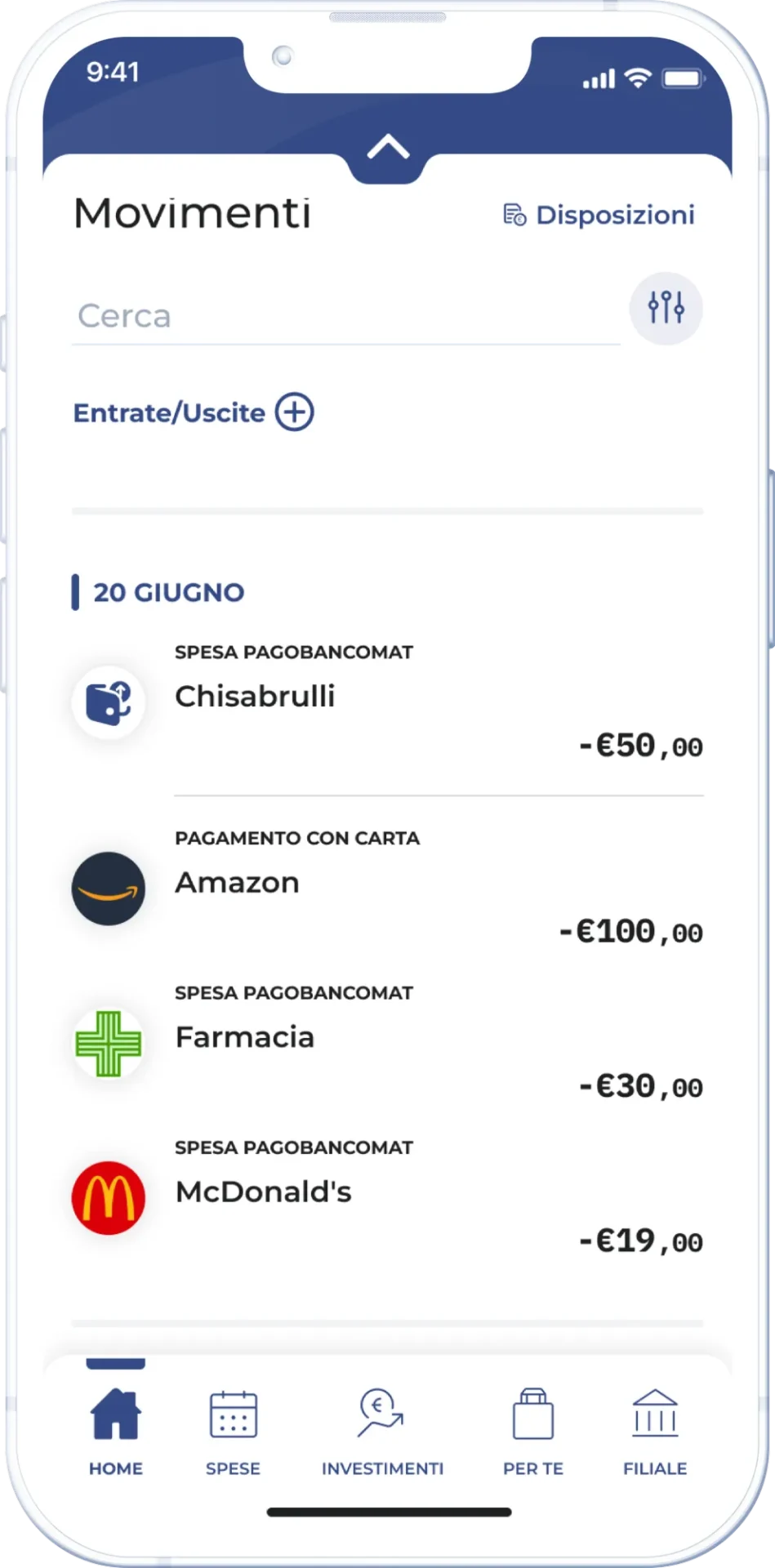

By integrating Snowdrop’s enrichment technology — powered by Google’s advanced AI algorithms and technology services — Banco BPM now displays clear, recognisable transaction summaries. Users can view detailed information, including the merchant’s brand, the transaction amount, date and time, a static map with geolocation, the address, and the business category.

Banco BPM app with transaction enrichment displaying the merchant logo, name and location on the map.

“We are committed to delivering the best possible digital banking experience to our customers, enriching our services with increasingly innovative and cutting-edge solutions. Thanks to the new feature available in our digital platforms, we can offer users greater clarity and control over their movements. This project is part of Banco BPM’s broader strategy to deliver an intuitive digital banking experience and is an example of how innovation and collaboration with fintechs can translate into tangible benefits for our clients.”

Luca Vanetti, Marketing and Omnichannel Business Manager at Banco BPM

Ken Hart, CEO of Snowdrop Solutions: “We are proud to partner with Banco BPM to bring enriched transaction data to life in Italy. This launch not only enhances the banking experience for customers and highlights our continued expansion across Southern Europe, with Banco BPM leading the way as our first partner in Italy. Through our advanced AI-driven solution, we’re enabling financial institutions to transform complex data into intuitive experiences.”

Banco BPM becomes Snowdrop’s first client in Italy, reinforcing the company’s commitment to expanding its intuitive banking solutions across the continent

About Banco BPM

Banco BPM is Italy’s third-largest banking group, formed in 2017 through the merger of Banco Popolare and Banca Popolare di Milano. Headquartered in Milan and Verona, the group serves approximately 4 million customers through a network of over 1,400 branches nationwide. With around 20,000 employees, Banco BPM maintains a strong presence in Northern Italy, particularly in Lombardy, Veneto, and Piedmont. The bank is listed on the FTSE MIB and is recognised for its commitment to digital innovation and customer-centric services.

Media contact

Media relations

stampa@bancobpm.it