Kard: Enhanced Transaction Clarity with 94% Merchant Cleaning Rate

Kard, the go-to pocket money app for teenagers and parents in France, enhanced its user experience with Snowdrop’s Enrichment API, transforming raw transaction data into clear, recognisable insights with clean names, categories, and logos – driving engagement and strengthening its market position.

Challenge

Enhanced Merchant Identification for Smarter Budget Management

Kard faced a challenge in ensuring users could easily recognise their transactions. Their in-house cleaning system achieved a 50% cleaning rate, and Kard identified they needed a higher rate to better display transaction details to their users. Kard’s customers needed a clear and reliable way to identify transactions – teens to recognise merchants and track expenses for better budget management, while parents sought transparency for their children’s financial safety. To address this, Kard needed a more robust solution to clean and enrich transaction data effectively.

Solution

Leveraging Enriched Data for Better Transaction Clarity

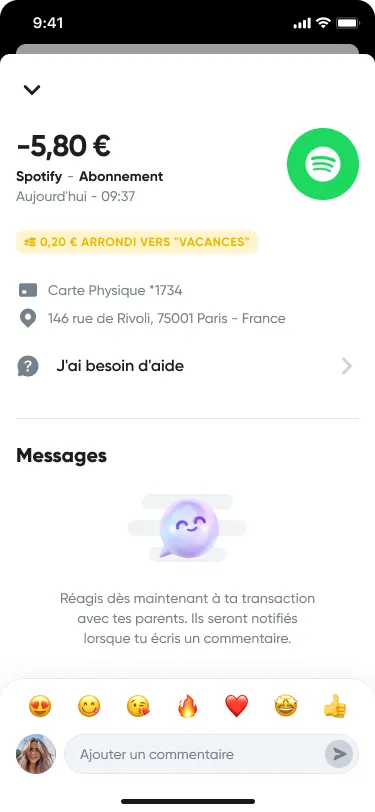

Kard integrated Snowdrop’s transaction enrichment solution, powered by Google’s technology, to transform raw transaction data into clear, user-friendly insights. This integration cleaned up merchant names, eliminating confusing or incomplete transaction details, categorised transactions to help users better understand their spending habits, and displayed merchant logos and brand icons for instant recognition.

Success

Boosting Clean Merchant Rate and User Experience

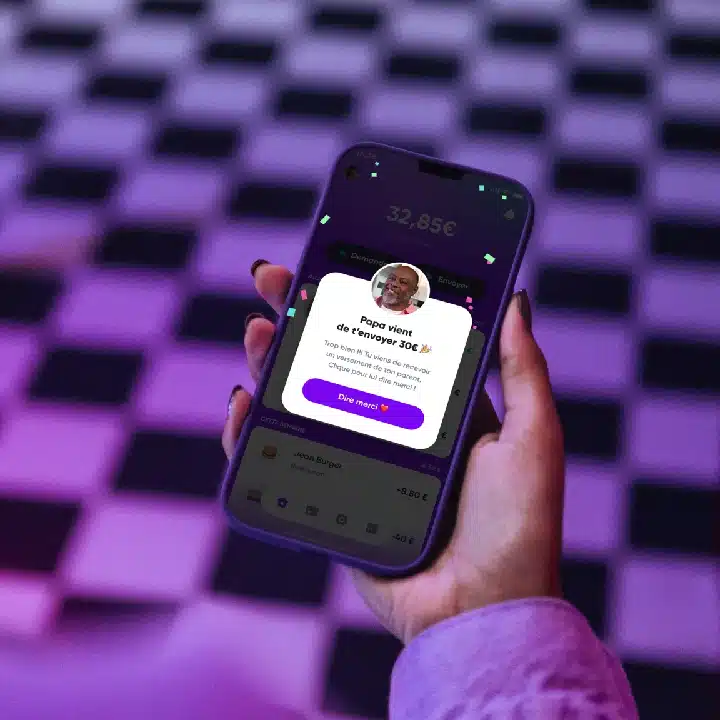

After implementing Snowdrop’s Enrichment API, Kard saw a significant improvement in the clarity of its transaction data. With Snowdrop’s solution in place, the clean merchant rate rose to over 94%, allowing users to easily recognise and understand their spending. This boost in data transparency led to stronger customer engagement and helped Kard stand out in a competitive market, reinforcing its reputation as an innovative, user-focused financial app designed for young people and their families.

“What can we say except that Snowdrop makes our daily lives easier and drastically improves our users’ experience? This is reflected, for example, in the fact that teenagers can see which merchants they have transacted with their Kard, a way of ensuring account security but also making it easier for parents to co-supervise the account.”

Romain Durritçague

Head of Engineering