September 9, 2025

Subaio and Snowdrop enter strategic partnership to advance data-driven banking

Aalborg, Denmark / London, United Kingdom – 9 September 2025

New collaboration brings together leading expertise in banking data and advanced transaction enrichment to unlock high-quality insights for banks and their customers.

Fintech company Subaio and transaction enrichment provider Snowdrop Solutions have announced a strategic partnership aimed at raising the standard for data quality in the financial sector. The partnership unites two complementary capabilities: Subaio’s advanced financial data analysis, and Snowdrop’s proven transaction enrichment technology that brings clarity and structure to raw financial data.

The partnership marks a significant step forward in helping banks unlock real value from their data; commercially, operationally, and for the end-customer. Together, the companies will enable financial institutions to deliver smarter, AI-powered services, grounded in accurate, real-time insights.

“The market is moving fast, and the demand for high-quality data has never been greater. With Snowdrop, we’ve found a partner who understands this shift, the need for high-quality data, and who complements our ability to convert complex data into tangible use cases. This partnership is about scaling that value to more markets – and doing it in a way that delivers meaningful and valuable outcomes for banks and their customers.”

Thomas Laursen, CEO & Co-Founder of Subaio

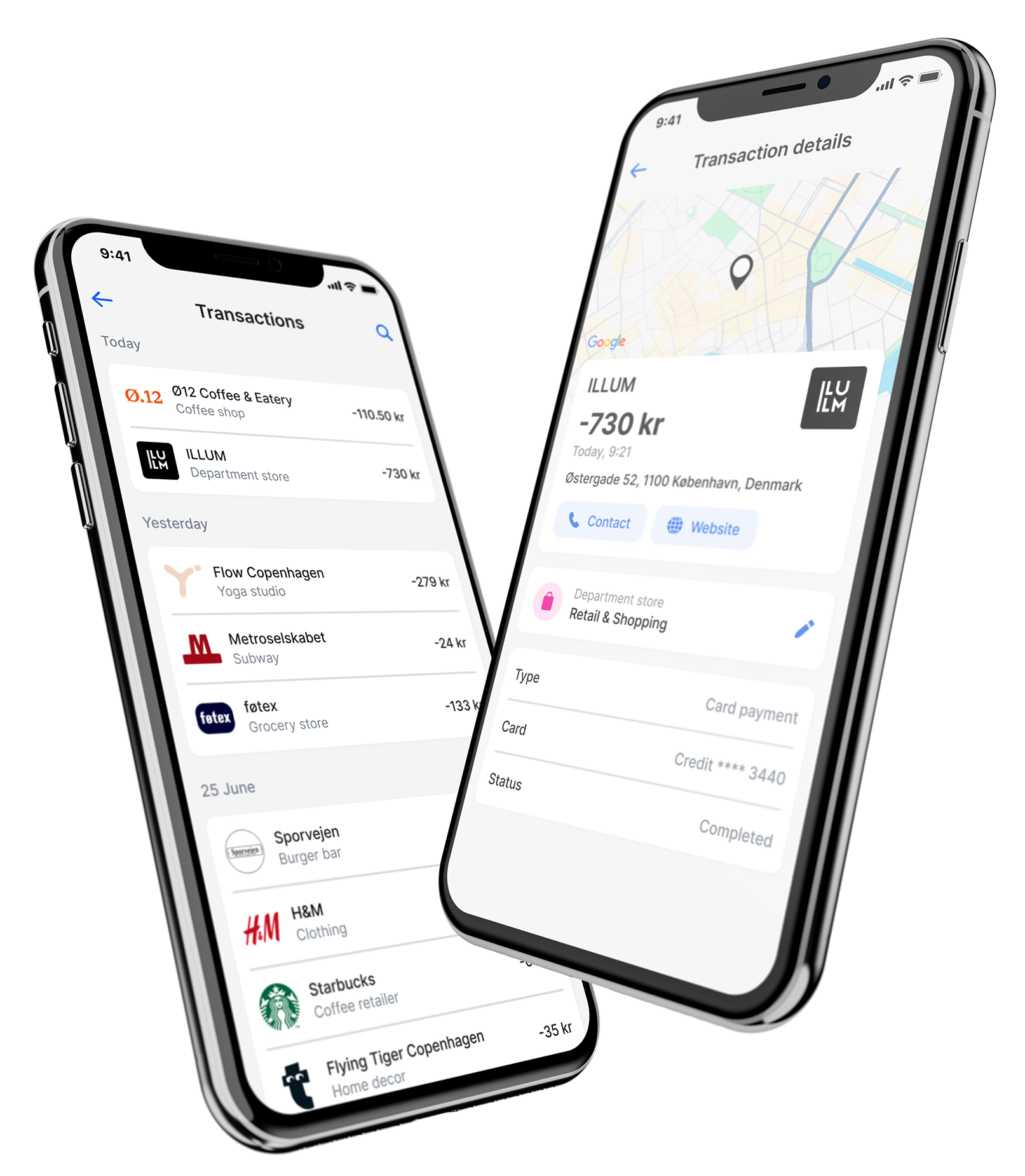

Both companies share a strong belief in the power of precision and clarity. While Snowdrop brings structure to messy transaction feeds – mapping merchant names, purchase categories, and geolocation – Subaio adds an understanding of customers’ financial situation and behaviour through highly insightful expense analysis, financial indicators and a deep understanding of what the customer has bought. The result is a joint offering that enables financial institutions to activate new services, drive digital engagement, and support financial inclusion with data they already possess.

“Subaio’s depth of expertise in recurring payment data is a natural fit for us. It enhances the intelligence of our enrichment layer and opens the door to more meaningful, intuitive banking experiences. We see great opportunity in bringing this combined solution to our clients across Europe.”

Ken Hart, CEO & Founder of UK-based Snowdrop Solutions

The agreement also represents a timely development for both parties. As Snowdrop adapts to a shifting partnership landscape, the collaboration with Subaio provides new commercial momentum and a clear value proposition to its banking partners. For Subaio, the partnership accelerates international expansion and reinforces its position as a trusted provider of white-label solutions for banks navigating the next phase of digital transformation.

About Subaio

Subaio is a Danish fintech company that delivers white-label solutions that help banks gain and utilize high-quality data insight on their customers and convert that into meaningful and valuable use cases. Together with its clients, Subaio has delivered numerous successful implementations, including solutions that help customers with their personal finance (PFM), manage subscriptions, assess creditworthiness, and drive contextual sales. Subaio supports financial institutions in becoming trusted, data-driven partners for their customers. The company works with leading banks across Europe and beyond.