January 15, 2026

Contextual signals in banking: Understanding customers beyond transactions

Every transaction, payment, or card swipe reveals something about a customer’s life. Yet even with all this information, banks often struggle to understand what it truly means for the people behind the numbers. When transaction data is interpreted in the right way, it becomes a rich source of insight into a customer’s day-to-day behaviour and long-term needs. These insights are what we refer to as contextual signals.

Most banking tools focus on transactions: rent paid, groceries purchased, salary deposited. But banks don’t see the context behind users’ financial decisions, why customers make those choices: their routines, their financial goals, or the life events influencing their decisions. Contextual signals change this dynamic by turning data into insight and insight into action – keeping them engaged, confident, and loyal.

Contextual banking as a new standard for experience and trust

A recent McKinsey report shows that banks that personalise customer interactions based on behaviour and context see 20–30% higher engagement rates and up to 10% increase in cross-sell conversion.

People are asking their banks to go beyond balance updates and statements. They want guidance that connects their financial activity to their real-world goals – support offered at the precise moment they need it.

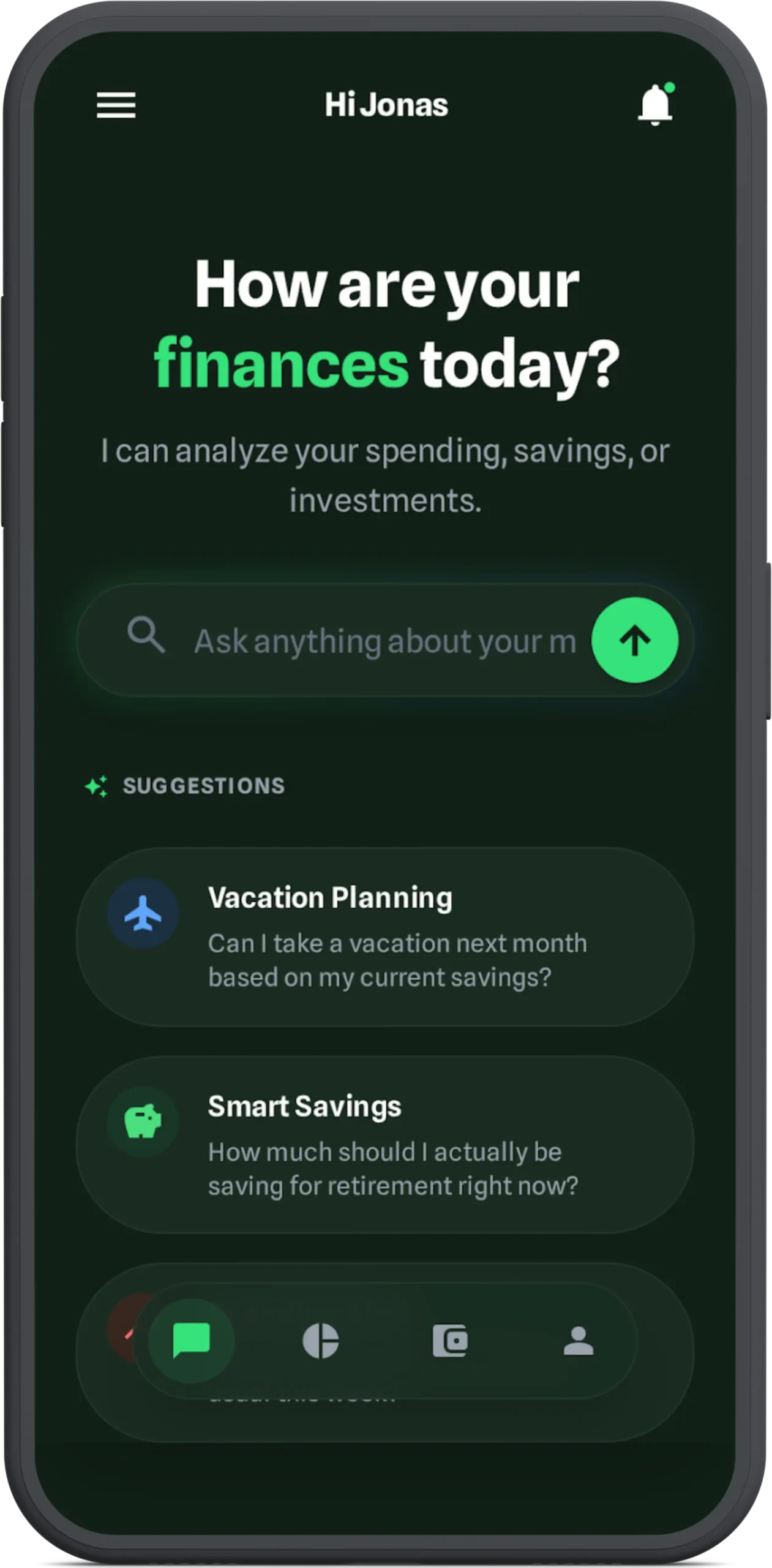

And these are the kinds of questions they wish their bank could answer:

– Can I take a vacation next month?

– How much should I actually be saving?

– Why is my spending higher than usual?

Showing a few pie charts and graphs from today’s Personal Finance Management don’t answer these questions. That’s why so few consumers – about 5% to 8% – actually use PFM tools.

Contextual banking, on the other hand, provides answers. It bridges everyday behaviour with long-term ambitions, analysing spending patterns, income rhythms, and life events to deliver insights that are timely, tailored and genuinely helpful.

Legacy vs. Digital: Two paths to contextual banking

The rising demand for contextual, intuitive banking has revealed a fundamental divide in how financial institutions approach customer experience..

Legacy banks: Product-centric

For decades, traditional banks focused on expanding their product shelves – new types of savings accounts, more cards, different loan variations. As the catalogue grew, so did the complexity. Customer journeys became fragmented, stitched together around internal processes rather than human needs. The result: customers had to navigate the bank’s structure on their own, often feeling like passengers in a system built for efficiency rather than clarity.

Modern digital banks: Problem-centric

The most successful digital banks took a different route. Instead of adding more products, they focused on solving everyday financial problems, such as:

- helping people understand their spending

- simplifying budgeting

- offering guidance instead of static information

- building tools around goals, not product lines

They started with the customer’s life, not the bank’s catalogue, and designed backward from there.

| ✅ reducing friction | ✅ offering instant insights |

| ✅ eliminating confusion | ✅ speaking in human language |

| ✅ making money easier to understand | ✅ simplifying what had been unnecessarily complicated |

Digital banks won not through quantity, but rather with clarity, trust, and transparency. They made people feel in control of their financial lives, something legacy systems had struggled to achieve.

Context: The new currency of customer loyalty

Is knowing your balance really enough? Industry surveys consistently show that over 70% of banking customers want intuitive, contextual insights. They want to see how their money connects to their lives, how it helps them reach goals, fits into daily routines, and guides the choices they make. They want context for every decision: whether a weekend getaway is possible without touching savings, or how much to set aside for future plans.

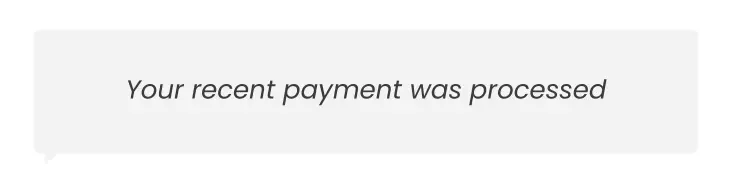

Take something as simple as paying rent every month for two years. To a traditional banking system, it’s nothing more than a timestamped transaction – processed, recorded, and quickly forgotten.

A bank powered by contextual intelligence sees something entirely different.

Consider the example below:

| What contextual signals detect | What bank can offer |

|---|---|

| Long-term consistency | Flag potential eligibility for a mortgage |

| Reliable cash-flow management | Recommend saving for a deposit |

| Stability in residency | Offer tools to compare renting vs owning |

| Predictable recurring expenses | Provide credit-score improvement tips |

| Potential interest in long-term housing options | Trigger personalised nudges at key life moments |

This transforms a simple rent payment from a routine transaction into a strategic touchpoint. With this approach, customers respond to contextual messages 3x times more than they do to generic alerts, conversion into mortgage exploration increases by 15–25%, and customer satisfaction rises by 30–40%.

By understanding context, banks move beyond reacting to numbers and start genuinely supporting the people behind them.

Four key types of contextual signals banks can use

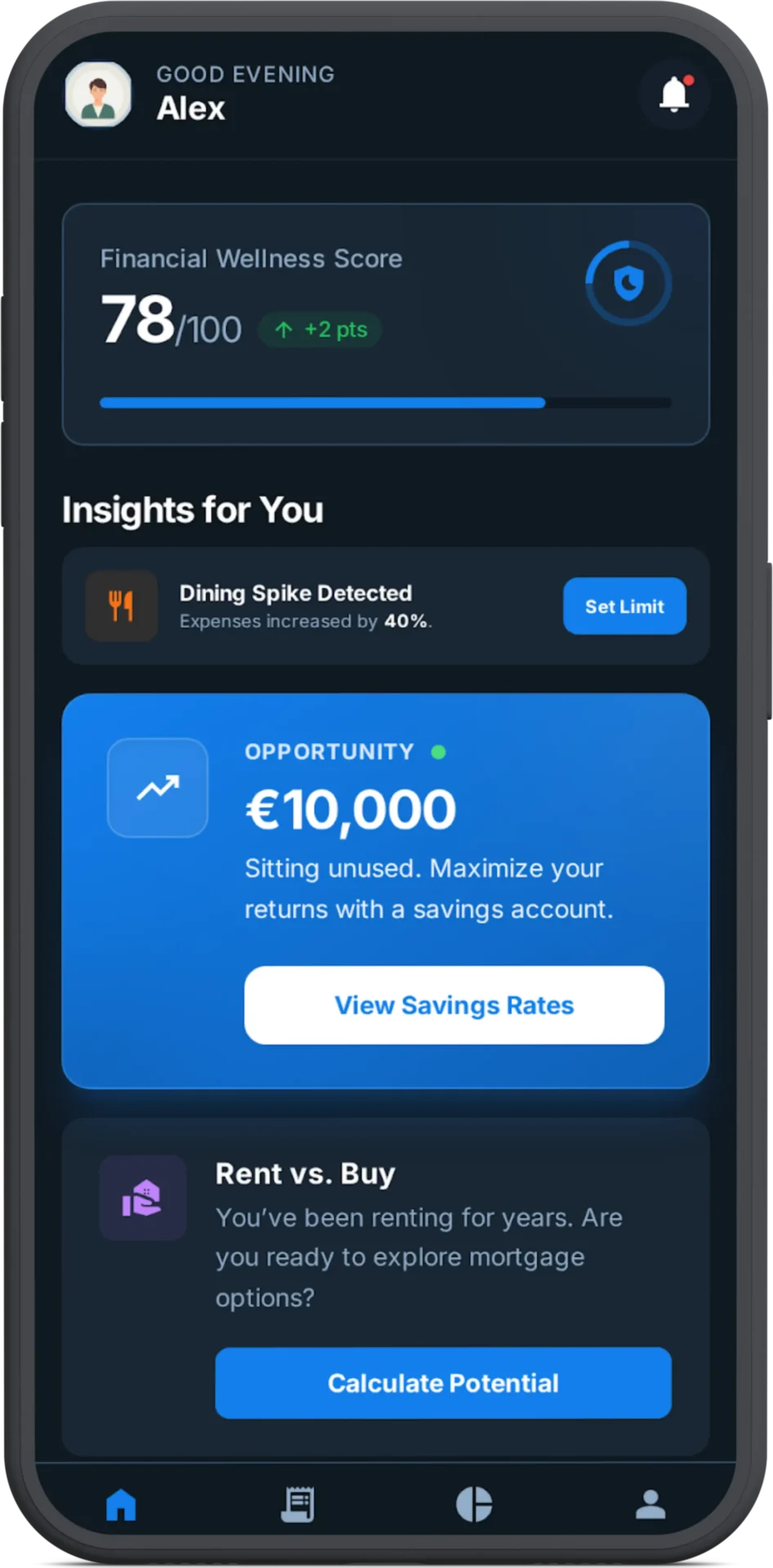

1. Behavioural signals

Detect changes in spending or saving habits

➡️ For instance: “Your dining expenses have increased by 40%. Would you like to set a smart limit?” Contextual systems can then offer actionable guidance, such as adjusting budgets or setting limits to help prevent overspending.

2. Financial opportunity signals

Identify areas where customers could make their money work harder.

➡️ For instance, “You’ve had €10,000 sitting unused. Consider moving it to a high-yield savings account.”

These insights help customers optimise their finances and allow banks to provide value beyond simple account management.

3. Life-event signals

Recognise key milestones through behavior and transaction patterns.

➡️ For example, “You’ve been renting for years, are you ready to explore mortgage options?”

These meaningful touchpoints create the kind of emotional connection that traditional banks often fail to unlock.

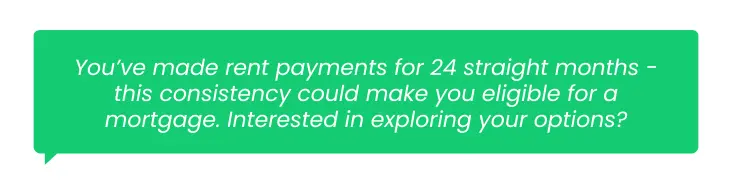

4. Predictive signals

Anticipate what may happen next in a customer’s financial life.

➡️ For example, “At this rate, you’ll exceed your grocery budget by €50.”

This gives customers foresight, an experience that feels almost magical when done well.

Created with Stitch for illustrative purposes only, not a real product.

How contextual signals work together

Signals rarely exist in isolation. A single signal – like a high dining expense – may mean little by itself. But when combined with recurring patterns, life events, and predictive analytics, it gives more insight:

- Recurring rent payments + steady income deposits = stability, possibly mortgage eligibility.

- Increased online subscriptions + higher discretionary spending = a lifestyle change, maybe indicating a new household or hobbies.

- Large idle balances + upcoming recurring expenses = an opportunity for automated savings or investments.

This multi-dimensional view of contextual signals transforms routine financial data into actionable insight, allowing systems to act intelligently rather than just report facts.

Unlock engagement and trust through context

Context does more than enrich data, it transforms engagement. It ensures customers receive the right message at the right moment, avoiding a flood of generic notifications.

When executed well, contextual signals:

- Increase engagement and retention

- Build trust through timely, relevant guidance

- Unlock natural, customer-centric cross-sell moments

- Reinforce the bank’s role as a partner – not just a platform

Ultimately, contextual banking isn’t about predicting behaviour, it’s about understanding intent and supporting customers in the moments that matter.

How context will define the banking experience of tomorrow

As banking becomes conversational, driven by AI-powered technology, contextual signals will form the backbone of every interaction. By 2028, 70% of customer journeys are expected to occur entirely through AI-driven conversational interfaces.

Imagine a financial assistant that understands your goals, habits, commitments, and financial rhythm. It doesn’t wait for you to ask “How much can I spend on travel?”

It informs you before you even book the flight.

The outcome is a banking experience that is intuitive, responsive, and fully integrated, where context and intelligence guide every financial decision.

In conclusion

Banks need revenue, but long-term growth doesn’t come from pushing products, it comes from building trust. The financial apps that grew fastest in the past decade did so because they focused relentlessly on users: their pain points, their anxieties, their aspirations.

Contextual signals bring that same philosophy into mainstream banking.

They help create experiences that are intuitive, supportive, and emotionally resonant. Over time, these experiences lead to higher engagement, deeper relationships, and greater adoption of financial products.

Head of Digital Marketing

Fintech-focused digital marketer with a passion for travel, hiking, and history. Leading digital strategy and social media for a tech company. Always exploring the latest industry trends.