MRS API

-

Kroo Bank: Clearer Transaction Insights with Location-Powered Enrichment

Learn how Kroo Bank integrated Snowdrop’s enrichment API, boosting users' confidence and significantly reducing support queries.

-

Contextual signals in banking: Understanding customers beyond transactions

Discover how contextual signals help modern banks understand customer needs beyond transactions to drive better engagement and decisions.

-

Visa enhanced merchant data requirements 2027: How to comply

Discover Visa’s enhanced merchant data, understand its purpose for businesses, and explore practical steps to meet compliance requirements.

-

What is Contextual Banking? Building on the foundation of transaction data enrichment

Learn more about contextual banking and how it creates intuitive, relevant experiences that go beyond personalisation.

-

How transaction enrichment boosts banking engagement and customer retention

Discover how five financial institutions are transforming customer engagement through innovative transaction enrichment strategies.

-

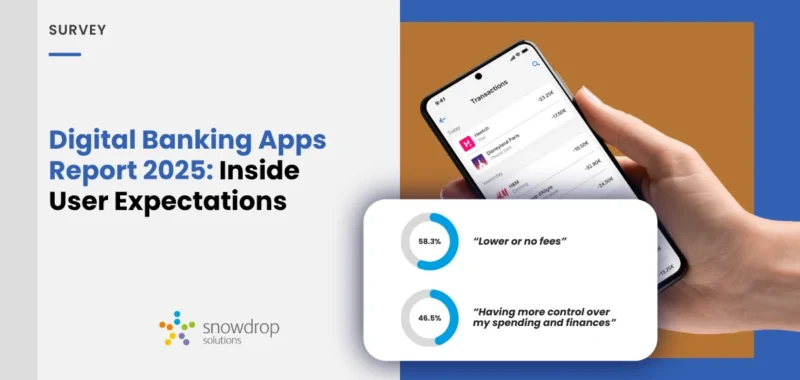

Digital banking apps report 2025

Check out our latest report on the use of digital banking apps in 2025 and discover what users think and want when it comes to banking apps.

-

How to transform financial transaction data with machine learning

Learn how Snowdrop's proprietary engine transforms raw transaction strings into the clean, structured data that powers truly intuitive banking.

-

Subaio and Snowdrop enter strategic partnership to advance data-driven banking

Subaio and Snowdrop partnership has the aim of providing high-quality and data-driven information to banks and their customers.

-

Transform KYC processes in digital banking with location data

Discover how banks and fintechs can strengthen their KYC process with geospatial tools to boost compliance, reduce fraud, and improve onboarding.

-

Chocolate Finance delivers smarter, clearer transactions for an intuitive app journey

Chocolate Finance improves clarity of everyday cash management by integrating transaction enrichment API into its platform.

-

Banco BPM launches AI-driven transaction enrichment in collaboration with Snowdrop

Banco BPM becomes the first bank in Italy to display clear, enriched transaction data in its mobile banking app.

-

COSMOTE introduces enriched transactions for a more transparent banking experience

COSMOTE Payments now displays merchant names, logos and categories; helping customers better understand where and how they spend.