April 4, 2023

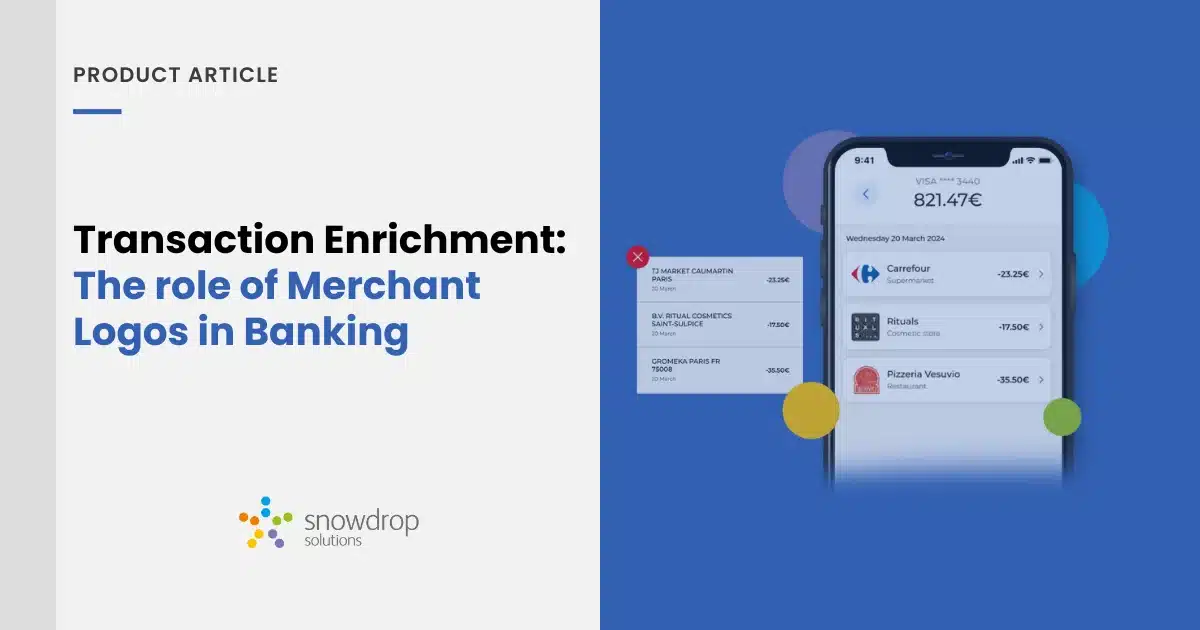

Transaction Data Enrichment: The Role of Merchant Logos in Banking

Last updated on: February 6, 2025

Reviewed by: Ana Cantero

Merchant logos are an essential component of branding. They are the graphical representation of a company’s identity and serve as a visual cue that helps customers recognise and remember the brand. In this article, we will explore the importance of merchant logos in transaction data enrichment and how it has become a vital tool for banks and financial institutions.

Merchant logos make it so much easier for customers to recognise and understand their transactions, whether on a bank statement or in a digital banking app. When people see a familiar logo, it boosts their confidence that the business is legit and that their transaction is secure. Linking those logos to transactions gives clear visual cues, helping cardholders quickly spot legitimate purchases. It’s a simple yet powerful way to enhance transparency, build trust, and make banking more reassuring for everyone.

What are the benefits of adding a merchant logo to a banking transaction?

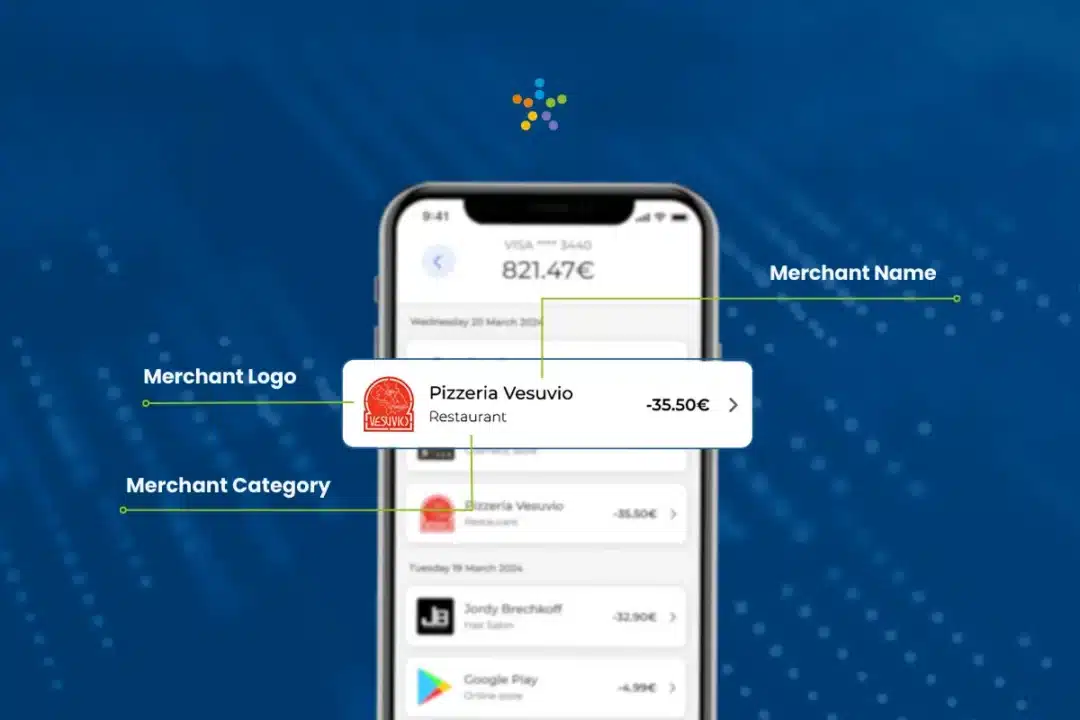

Including a merchant’s logo in banking transactions can offer various advantages for both the merchant and the customer. Here are some of the ways in which logos can contribute to data enrichment:

- Brand recognition: Merchant logos boost brand recognition and visibility, driving increased customer loyalty and higher sales.

- Trust and security: Merchant logos on transactions enhance trust and security by verifying legitimacy and merchant authorisation.

- Enhanced customer experience: They enhance transaction records, offering personalisation and clarity, simplifying purchase tracking, and improving the overall customer experience.

- Reduced disputes and chargebacks: Customers are more likely to recognize transactions made with a familiar merchant, which helps reduce disputes.

For example, UK-based Nationwide Building Society worked with Visa and Snowdrop to pilot the MRS API. In the first 3 months alone, they’ve experienced a 30% reduction in the number of transaction query calls made to the customer service team.

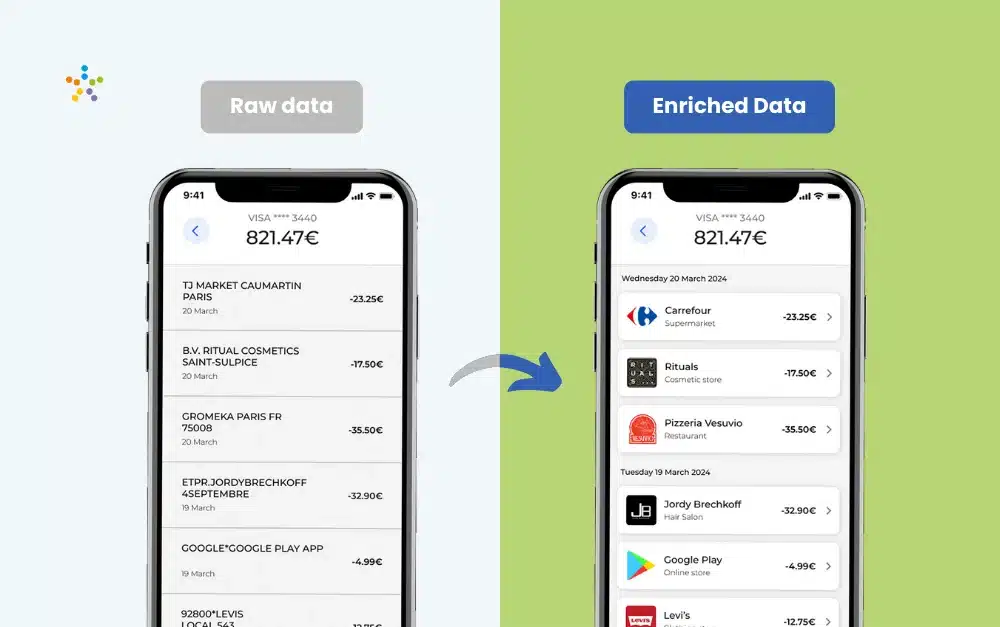

How does Snowdrop’s Transaction Enrichment API enhance the user experience?

By providing users with logos and transaction categorisation, the banking experience becomes more personalised and open. This can increase consumer confidence in the bank and encourage customers to continue using their services. Enriched data helps banks understand customers’ spending habits, enabling them to offer more personalised recommendations and offers.

Snowdrop Solutions simplifies transaction enrichment, allowing your teams to focus on unique features in the roadmap. The MRS API, powered by Google Cloud, is highly accurate, reliable, and deployable with little resources required from you. We handle complex details like names, addresses, logos, icons, and related issues to ensure a seamless transaction enrichment process.

Partnering with Visa and Google enables us to share best practices across financial services, real estate, travel, and transportation.

How can Snowdrop Solutions help?

Merchant logos play a crucial role in transaction data enrichment in the banking industry. By leveraging enriched merchant information and precise location data, banks can offer a more personalised, transparent service that users trust.

Rising consumer demand for transparency drives banks to use transaction enrichment, delivering detailed information and improving the customer experience.

Want to learn more about how MRS API can help your business? Contact us now and let us help you take your business to the next level.

Marketing & Comms Director

Seasoned Marcomms professional with 8+ years of experience in brand management and digital communications. I thrive on creating impactful content and creative strategies, leveraging location-enhanced data enrichment insights for financial and digital technology companies. In my spare time, I nurture my mind and spirit through creative pursuits and immersive reading.