July 28, 2025

Transform KYC processes in digital banking with location data

Know Your Customer (KYC) has long been a cornerstone of compliance in banking and financial services. But as regulatory scrutiny increases and criminal tactics evolve, traditional KYC approaches are showing their limits. Fines for inadequate KYC controls are becoming more common—and more costly—not only in terms of revenue, but also in customer trust and operational impact.

In today’s landscape, it’s not enough to meet the bare minimum. Whether you’re a digital bank, fintech or payment provider, strengthening your KYC process is essential to stay compliant, competitive and secure.

The hidden cost of poor KYC processes

A weak or outdated KYC process can lead to:

- Increased fraud risk due to identity misrepresentation

- Onboarding drop-offs from overly complex or manual flows

- Reputational damage in the wake of regulatory sanctions

- Operational inefficiencies caused by bad data or manual reviews

In a market where customer expectations are rising and regulators are paying closer attention, poor KYC isn’t just a back-office issue—it’s a strategic risk.

Smarter, ongoing KYC is the new standard

Traditionally, KYC has been seen as a one-off task at onboarding. But this static approach no longer meets the needs of a dynamic, data-rich financial ecosystem. Institutions need to adopt automated, risk-based, and ongoing KYC frameworks that evolve with their customers. Modern KYC processes combine:

- Real-time identity and document verification

- Behavioural and geolocation analysis

- Ongoing risk monitoring and remediation

This continuous approach reduces exposure while making the experience smoother for legitimate users.

How location intelligence can help strengthen KYC in banking

A key part of any KYC process is verifying a customer’s address—quickly, accurately, and with minimal friction. This step is often underestimated, yet it plays a crucial role in both identity verification and fraud prevention. In fact, as many as 5% of all addresses are entered incorrectly when signing up for a new account, credit card or loan. These errors can result in failed verifications, lower conversion rates, inaccurate CRM records, and even costly operational issues down the line.

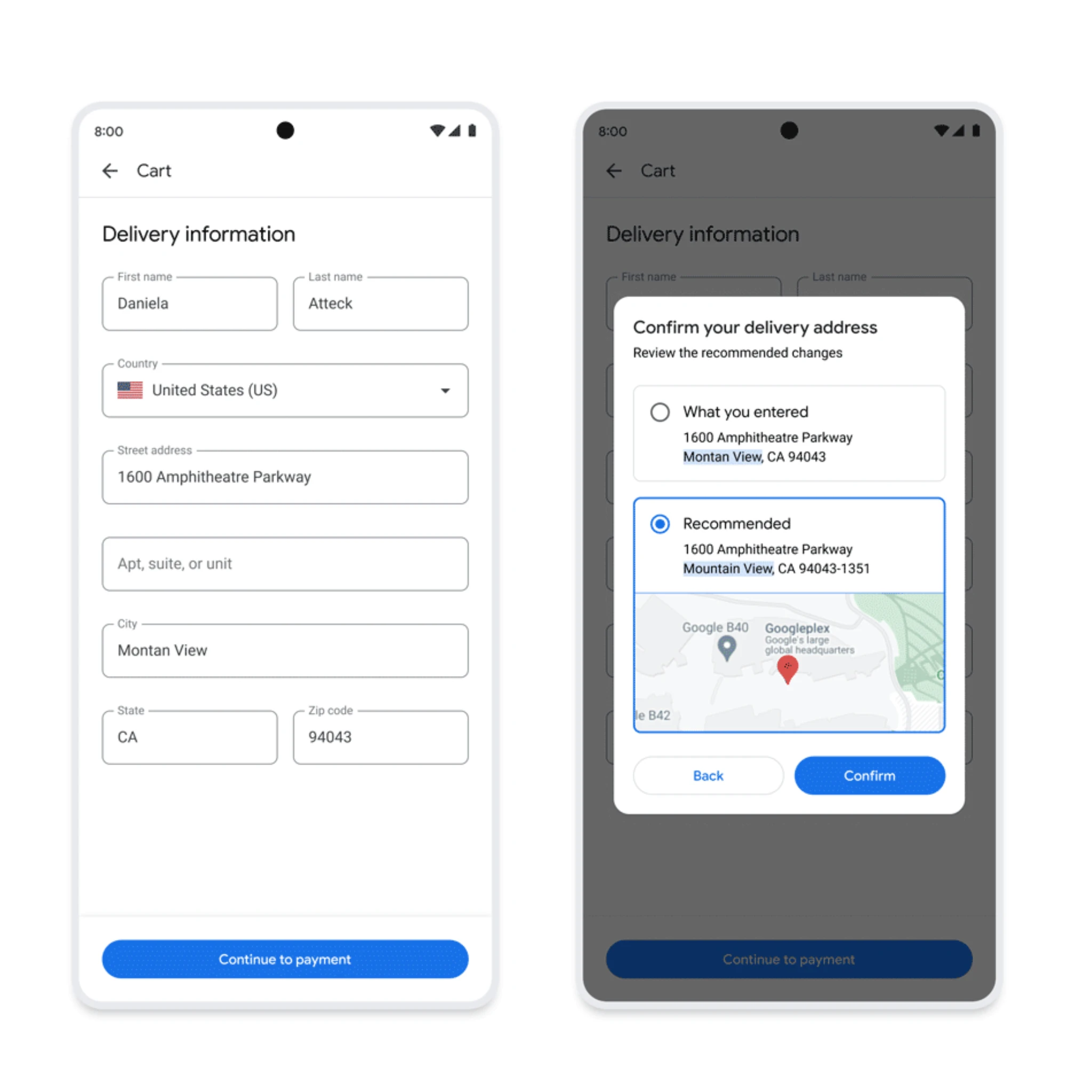

Google Maps Platform offers a suite of geolocation tools that help financial institutions streamline this process and improve data quality from the start. By combining Autocomplete API, Address Validation, and Geocoding API, banks and fintechs can simplify how users enter their addresses, verify that they exist, and convert them into precise coordinates.

- Autocomplete API helps users enter even complex addresses quickly and accurately. As users type, it suggests valid addresses in real time, significantly reducing manual entry errors.

- Address Validation API checks and corrects submitted data, filling in missing fields or fixing spelling mistakes, ensuring consistent, clean records for compliance and operations.

- Geocoding API turns verified addresses into coordinates, helping systems link physical locations to customer profiles and transactions.

To further strengthen the banking KYC process, institutions can also use the Geolocation API and Maps API to compare a user’s claimed location with their actual location during onboarding. For example, if a bank needs to verify a user’s home address, they can request location access from the user’s device. The phone’s GPS identifies where the user is, and a map pin displays their location. By measuring the distance between the device’s location and the provided address, banks can add an extra layer of verification, reducing the risk of fraud and increasing confidence to instantly issue digital banking products, like virtual cards. This visual confirmation is not only intuitive for users, but also improves compliance by ensuring that onboarding data is both accurate and verifiable.

From reducing drop-off during onboarding to improving compliance and operational efficiency, geospatial data adds real value to KYC—helping build trust from the very first interaction.

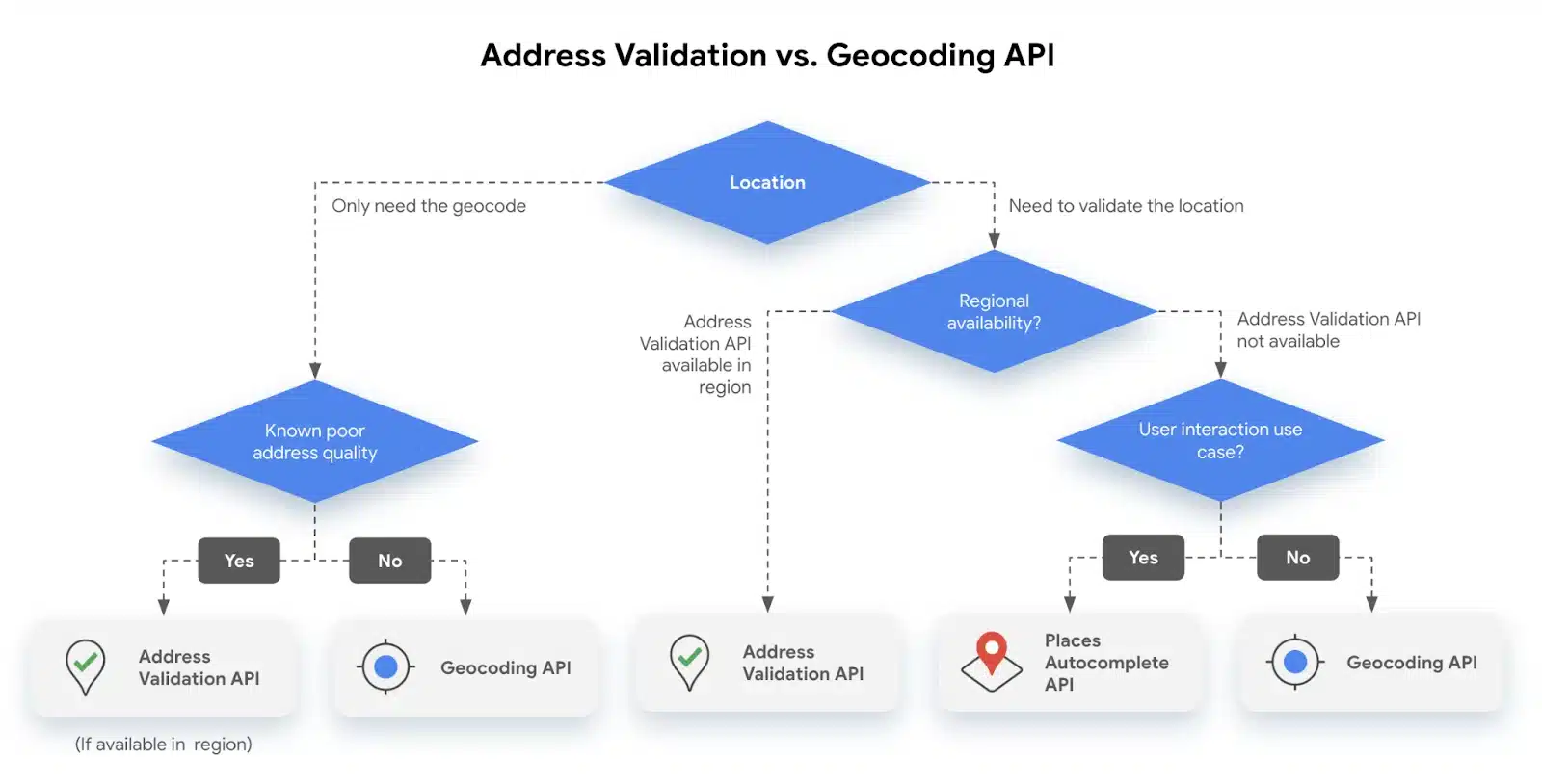

Understanding the difference: Address validation vs Geocoding APIs

Depending on your specific use case, one API might serve you better than the other—or you may benefit from using both in tandem.

You might prefer Address Validation API when:

- There’s a high chance of questionable data, or incorrect addresses would have a negative downstream impact.

- You need to correct user inputs, like misspellings or missing fields.

- Your target region returns more detailed metadata—such as classifying a building as residential or commercial.

You might choose Geocoding API when:

- Your main goal is to retrieve a location, and absolute precision isn’t critical (e.g. generating heatmaps).

- You need a global solution, as Address Validation is not available in all countries.

In many scenarios, using both APIs together can deliver optimal results—balancing validation accuracy with broad coverage and location-based insights.

Real impact: What the numbers say

Integrating location intelligence into onboarding processes can deliver tangible results:

30% reduction in fraudulent account setups when using geospatial data to verify identity

80% boost in click-through rates by tailoring services with location data

Improved operational efficiency by reducing manual reviews linked to address mismatches

These gains reflect the dual value of geospatial tools: enhancing both compliance and user experience.

Conclusion: Securing KYC for digital banking

As financial services continue to digitise, the pressure to deliver both frictionless experiences and robust security will only grow. Strengthening your KYC framework—with smart automation, continuous monitoring and the right tools—can help you:

- Stay ahead of evolving compliance requirements

- Reduce onboarding risk and fraud

- Build stronger, longer-lasting customer relationships

At the heart of it all is trust. And trust begins with knowing your customer—accurately, efficiently, and securely.

If you’re exploring how to optimise your KYC process or enhance onboarding with location data, our team can help. Get in touch with our location experts to know how to best strengthen your bank’s KYC digital processes.

Marketing & Comms Director

Seasoned Marcomms professional with 8+ years of experience in brand management and digital communications. I thrive on creating impactful content and creative strategies, leveraging location-enhanced data enrichment insights for financial and digital technology companies. In my spare time, I nurture my mind and spirit through creative pursuits and immersive reading.