November 10, 2025

What is Contextual Banking? Building on the foundation of transaction data enrichment

Contextual banking is the next evolution in digital banking experiences. At its core, it means creating meaningful interactions with consumers by using information relevant to their specific financial needs at any moment in time. To be clear, it is not about showing transaction clarity, nor is it just about personalising the banking experience. It is about understanding the habits, needs, and goals behind each user’s financial journey and engaging them with the products and services that make sense.

Built on the foundation of transaction data enrichment, contextual banking enables banks and fintechs to move from simply displaying information to delivering truly intuitive and engaging experiences.

What is contextual banking?

Contextual banking is the ability to understand the meaning behind customer transactions and financial behaviour. Instead of just recording “what happened”, it provides the “why” and “how”, enabling banks to deliver timely, relevant, and supportive solutions.

Contextual banking can take many forms:

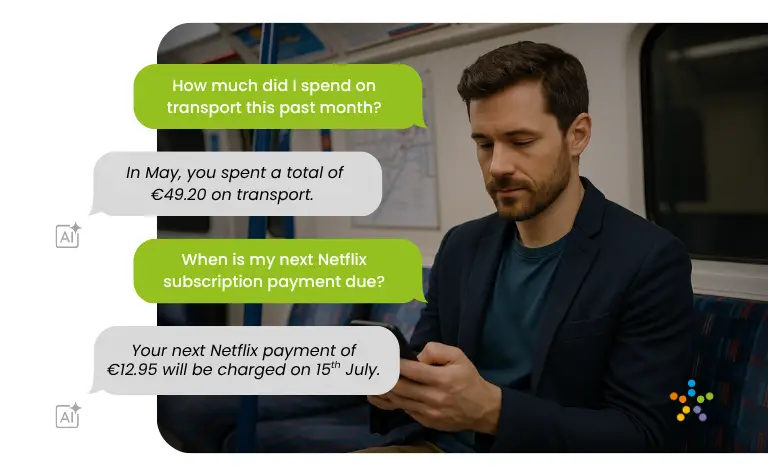

Conversational Context

Through intelligent interactions, customers can ask natural questions about their finances and receive clear, data-driven insights.

- “Why is my balance lower this month?” : “You had two unusual expenses — a new phone (€780) and car maintenance (€240). Excluding these, your spending was typical.”

- “How much did I spend on groceries last month?” “You spent €420, which is 8% less than your 3-month average. Nice work — if you keep this up, you could save €250/year.”

Situational Context

By analysing real-time account activity, banks can identify opportunities or risks and respond with meaningful recommendations.

- “Your checking account balance has been above €10,000 for two months — you could move €8,000 to a high-yield savings account earning 3.5% interest.”

- “You’re paying €1,200 in rent. Based on your income and savings, you might qualify for a first-time homebuyer mortgage.”

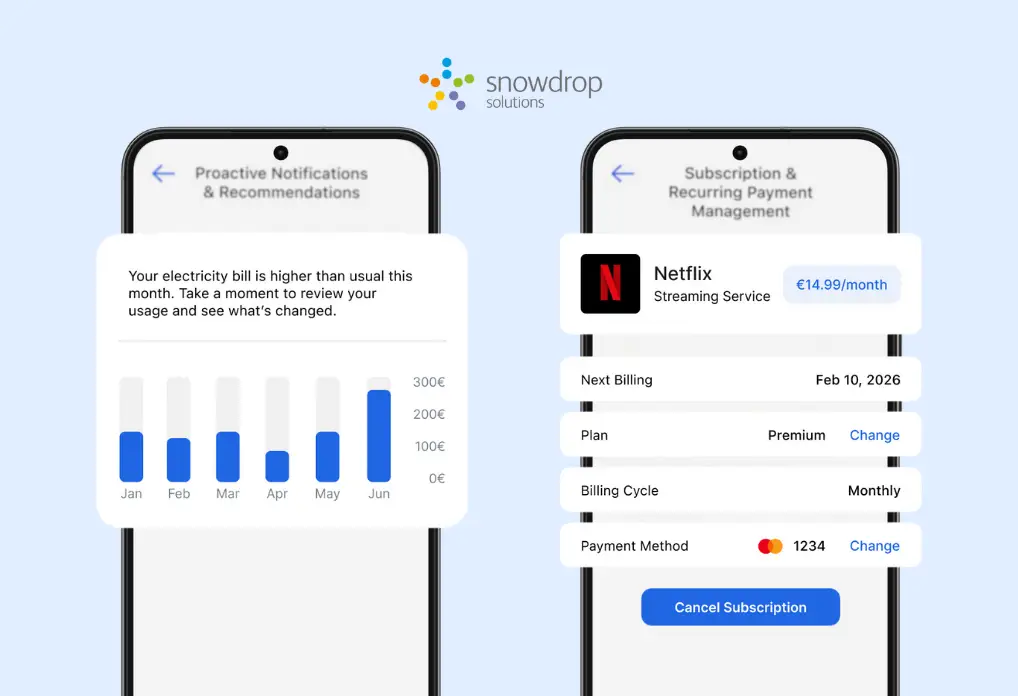

Behavioral Context

By recognising spending patterns and habits, banks can guide users towards better financial choices.

- “You have 5 active streaming services. Canceling one could save €120 per year.”

- “Am I spending too much on eating out?” “Dining is 12% of your total spend, compared to an average of 8% among similar customers. Cutting one dinner out per week could save €600/year.”

Why transaction enrichment is the foundation of contextual banking

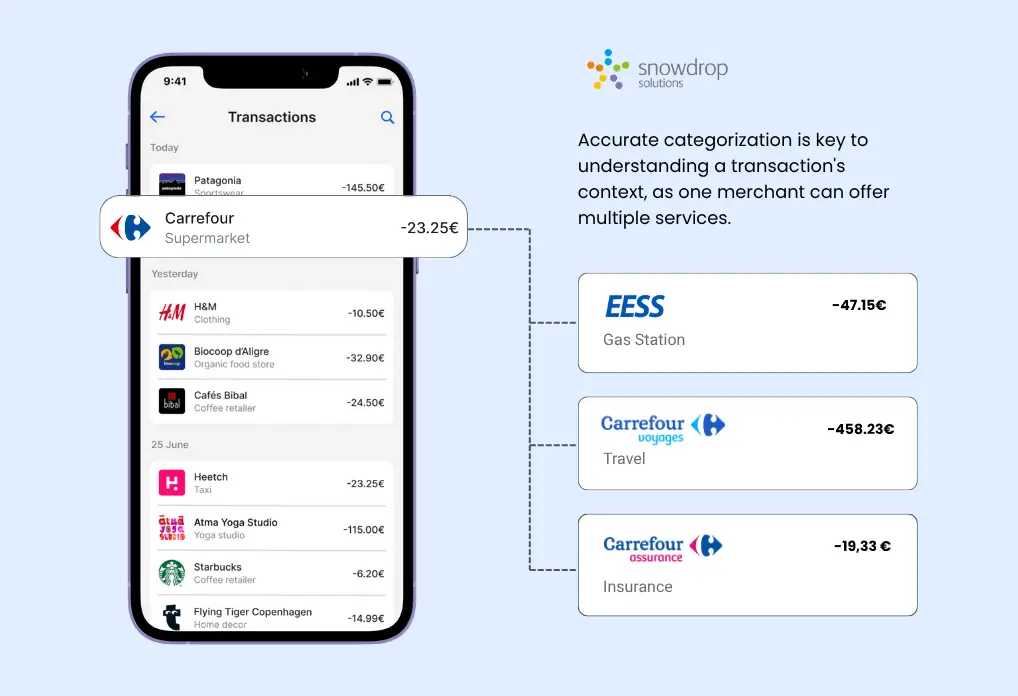

Transaction data enrichment transforms raw, confusing data into clean and clear insights: merchant names and logos, locations, categories and more. This has consistently demonstrated the ability to build trust with customers as well as reduce friction in digital banking.

But transaction enrichment is only the starting point to better digital banking; it is a foundation component upon which to build new engagement services. Without structured, accurate data, determining consumer context is impossible. Contextual banking relies on enriched transactions to identify patterns, detect goals, and guide customers intuitively.

For example, Specialised NLP pipelines can be applied to transform confusing transaction strings into consistent entities, eliminating noise and grouping brand names to improve categorisation and analysis.

How contextual banking helps create intuitive digital experiences

Contextual banking enables financial institutions to go beyond standard digital services and build deeper, more valuable relationships with their customers. By combining clear transaction data with contextual insights, banks can anticipate needs, reduce complexity, and provide meaningful support. Most importantly, it is not just personalisation of the user experience. Personalised banking is knowing “who” the customer is, contextual banking is knowing “what”, “when” and “why” a customer is interacting with the bank.

For example, when customers demonstrate consistent saving habits, banks can suggest relevant financial solutions at the right moment. If spending patterns show an increase in everyday expenses, intuitive alerts or budgeting tools can help customers adjust smoothly. Changes in subscription or recurring payments could trigger reminders or optimisation suggestions, helping customers manage their finances efficiently.

These experiences are not only relevant and timely but also help banks reduce customer service costs, increase engagement, and open up smarter growth opportunities. Most importantly, they strengthen trust. When customers feel that their bank understands their habits and supports their goals, loyalty and long-term relationships follow naturally.

The role of AI in contextual banking

Artificial intelligence is the engine that makes contextual banking scalable. AI and machine learning can analyse enriched transaction data, detect behaviours, and anticipate customer needs with precision.

Technologies such as Google AI models enable banks to move from reactive service to predictive engagement, where support is delivered proactively, exactly when it matters.

Practical applications include:

- Enhanced enrichment: NLP models clean and normalise merchant data, ensuring every transaction is clear and reliable.

- Pattern detection: Machine learning identifies trends in customer spending and saving, providing insights that human analysts could easily miss.

- Real-time recommendations: AI systems surface relevant suggestions directly within the banking app, guiding customers towards smarter decisions.

This intelligence is what turns enriched data into actionable context, enabling banks to offer experiences that feel intuitive rather than transactional. Snowdrop is a pioneer in contextual banking by making it effortless for banks to deliver intelligence and personalisation without reinventing the wheel.

Snowdrop’s platform connects directly with existing banking data and systems, offering banks the ability to launch contextual insights in weeks with a proven, compliant, and customizable framework built for scale.

Conclusion: Contextual banking matters

Transaction data enrichment and contextual banking are not separate stages but complementary strengths. Enrichment ensures clarity and structure, while context transforms data into actionable, meaningful engagement. Together, they form the foundation of the future of digital banking: transparent, intuitive, and built around the customer’s world.

Banks and fintechs that embrace contextual banking today will be better placed to deliver services that feel truly supportive, foster long-term loyalty, and differentiate themselves in an increasingly competitive landscape.

Marketing & Comms Director

Seasoned Marcomms professional with 8+ years of experience in brand management and digital communications. I thrive on creating impactful content and creative strategies, leveraging location-enhanced data enrichment insights for financial and digital technology companies. In my spare time, I nurture my mind and spirit through creative pursuits and immersive reading.