April 4, 2022

Why should banks enrich transaction information?

4 minutes

Last updated on: February 6, 2025

Reviewed by: Ana Cantero

Banks are at a turning point, as customers now expect more – clearer insights, better personalisation, and a deeper understanding of their spending habits. Enriched transaction data has become essential to meet these expectations. To stay ahead, banks must leverage a financial transaction API to stay ahead.

Enriched, highly accurate transaction data is crucial for any bank looking to compete in an increasingly demanding sector where customer experience and trust are paramount, especially as digital banking services expand. This is where advanced technologies like transaction enrichment APIs make all the difference, turning raw data into valuable, actionable insights.

The Challenge: Inaccurate Data and Poor Consumer Experience

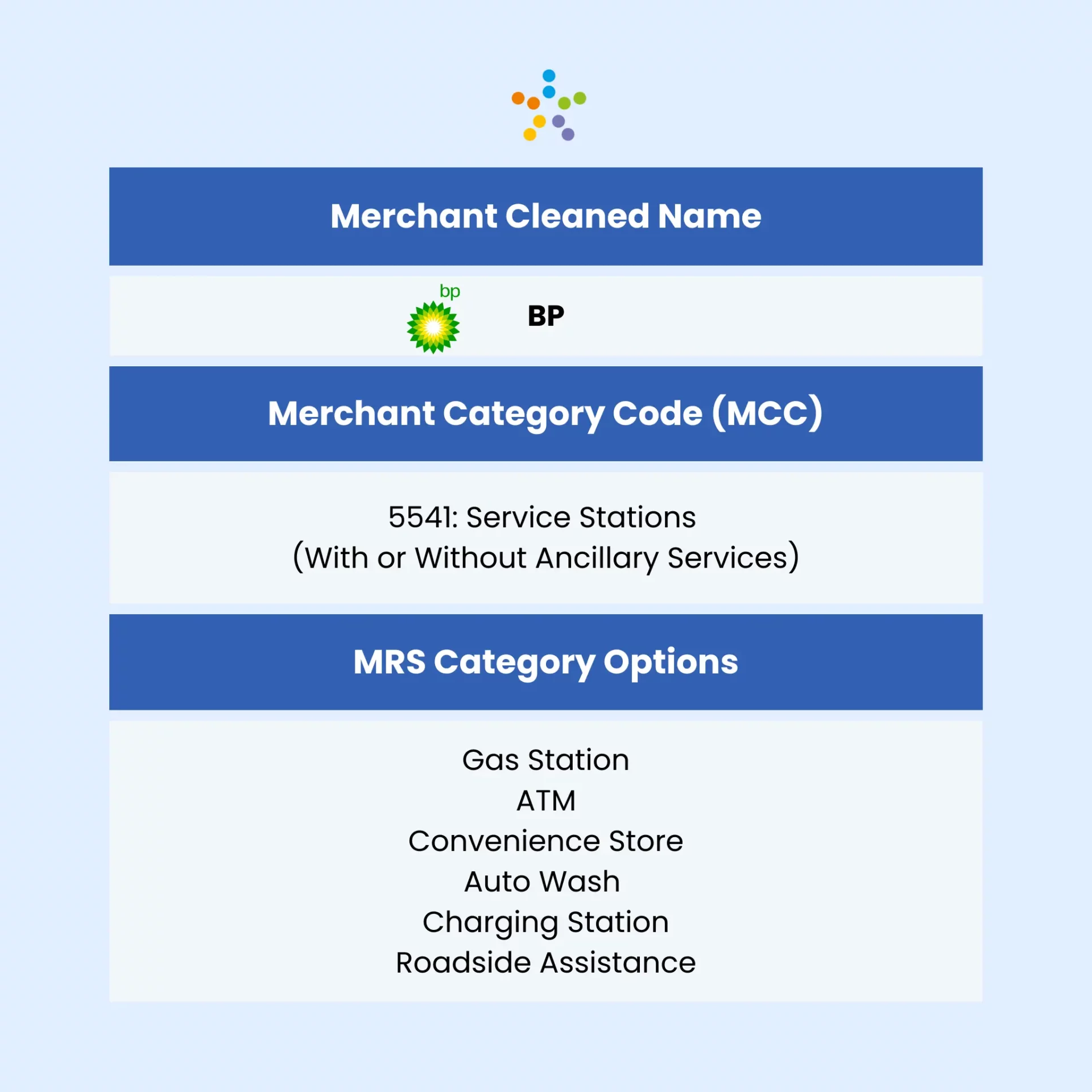

Many banks rely on Merchant Category Codes (MCC) to categorise transactions. A Merchant Category Code is a four-digit code listed in ISO 18245 for retail financial services, used to classify a business by the types of goods or services it provides. The goal is to show users how much they are spending on different categories like Shopping, Transportation, Entertainment, etc.

However, the way MCC codes are designed isn’t really focused with the customer experience in mind; they are more about setting pricing structures. Because of this, they often fail to provide accurate transaction data.

For example, a single transaction at a gas station could include fuel, groceries, or a car wash, but it often gets categorised as just “Service Station.” The lack of accurate transaction categorization can easily lead to confusion and frustration for consumers, and even worse, they might panic, thinking fraud has occurred.

Solution: Accurate Transaction Categorization Data with APIs

To tackle these challenges, banks are turning to Smart Transaction Categorization. This technology pulls together key data points – like merchant name, location, and MCC codes – to create more precise, relevant transaction categories. At Snowdrop Solutions, our advanced transaction enrichment API delivers around 95% match rates, so transaction data isn’t just accurate – it’s also consumer-friendly.

Why Accurate Transaction Data Enrichment Matters

- Better Consumer Experience: With context-aware data, banks can boost customer satisfaction and trust.

- Lower Call Centre Costs: Clear, enriched transaction info helps reduce customer inquiries and disputes.

- Stronger Loyalty Programs: Precise transaction categorization means rewards and loyalty points are allocated correctly, improving customer retention.

Unlocking New Opportunities with Accurate Transaction Data

Accurate transaction data enrichment opens up a world of possibilities for banks – it’s not just about categorising transactions. With enriched data, banks can offer innovative services that meet changing consumer needs and elevate their digital experiences.

Eco Footprint Tracking and ESG Impact

Take tracking carbon footprints, for example. By pinpointing the supermarket or merchant involved in a transaction and identifying the location, banks can estimate the carbon footprint of each purchase. Banks can also highlight key Environmental, Social, and Governance (ESG) factors tied to merchants, like sustainability practices or eco-friendly certifications. This gives customers a deeper understanding of how their spending aligns with their sustainability goals.

Precision in Loyalty Programs and Rewards

Enriched transaction data is essential for seamless loyalty and rewards programs. Without accurate merchant info, banks risk misallocating rewards. By using a location-enhanced transaction enrichment API, banks can ensure rewards and cashback go to the right merchant, boosting customer satisfaction and fostering long-term loyalty.

Why Transaction Data Enrichment in Banking Matters

The future of banking is all about using enriched transaction data to offer personalised, innovative, and secure services. We know that poor user experience can lead to high attrition rates. As customer expectations grow, banks that don’t prioritise a smooth, intuitive experience risk losing out to competitors who get it right.

By integrating a reliable transaction enrichment API with high accuracy and excellent match rates, banks can take their digital services to the next level, build stronger customer loyalty, and drive long-term growth.

Want to see how we can help your bank improve its user experience?

Marketing & Comms Director

Seasoned Marcomms professional with 8+ years of experience in brand management and digital communications. I thrive on creating impactful content and creative strategies, leveraging location-enhanced data enrichment insights for financial and digital technology companies. In my spare time, I nurture my mind and spirit through creative pursuits and immersive reading.