February 15, 2022

Why Choose Snowdrop for Accurate Transaction Data Enrichment?

Last updated on: December 2, 2025

Reviewed by: Ana Cantero

Even minor data gaps can have outsized effects in banking. “Good enough” enrichment often leads to incomplete coverage and outdated information, resulting in additional work for your teams. Choosing a cheaper provider isn’t always the smart move; look at accuracy, reliability, and trust.

How to Choose a Transaction Enrichment Provider

Selecting the right transaction enrichment provider can make or break your customer experience and operational efficiency. Seek a secure, scalable solution that integrates easily, delivers precise insights, and enhances transaction clarity.

Snowdrop Solutions offers a scalable, proven transaction enrichment API that enriches ambiguous payment data, turning raw transactions into contextual insights. The Merchant Reconciliation System (MRS) API, powered by Google Cloud and Google Maps, adds clarity and context to every transaction, helping banks deliver a more transparent and engaging user experience. Designed for rapid deployment, our API can be integrated in under six weeks, a timeline already achieved by several of our clients across Europe.

Key Benefits and Tangible Results of Using Snowdrop’s API:

- High Accuracy and Match Rates: With over 2.5 billion transactions processed monthly, our technology delivers highly accurate results, ensuring a seamless user experience.

- Global Expertise: Trusted by leading banks and fintechs worldwide, including Visa, Nationwide, Sabadell or PKO Bank Polski, our solution supports operations across 100+ territories.

- Proven Business Impact: Customers who deploy our API see measurable results, including:

- 15% increase in user engagement.

- 30% reduction in operational costs.

- 50% decrease in customer support calls related to transaction queries.

- Built on Google Cloud: Available through Google Cloud Marketplace, our API is easy to access, implement, and scale – saving your organisation significant time and resources.

Why Build When You Can Partner:

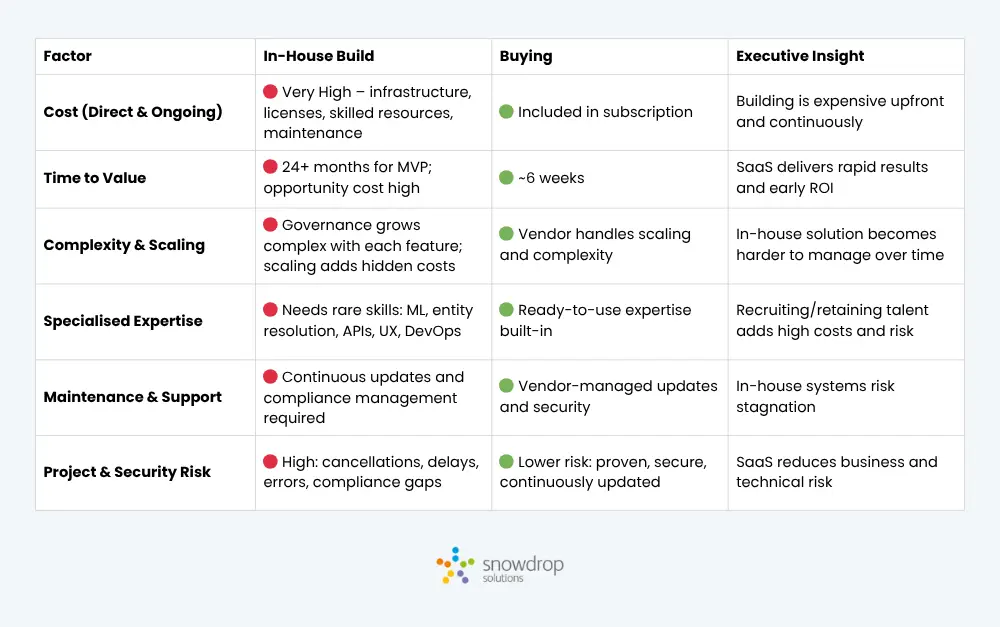

Consider the cost of infrastructure, software, and resources to compare the three-year cost differences between in-house development vs. off-the-shelf approaches.

For in-house development, you’ll need to budget for infrastructure, including building, testing, and deploying software, ensuring security, and maintaining high availability. In-house development also extends the time before the capabilities are operational. The opportunity cost of this delay may exceed 10X the cost of building a solution in-house, which can take 24 months or more.

- Resource Allocation: Developing a global merchant database, creating business rules, and maintaining updates consume valuable technical and legal resources. These efforts divert focus from your core business priorities.

- Time and Cost Inefficiency: Maintaining merchant details, fixing errors, and ensuring compliance across languages and regions requires a dedicated team—an ongoing expense that increases over time.

- Scalability Risks: Homegrown solutions struggle to match the scalability and accuracy of established APIs. As your customer base grows, so do the complexities of maintaining the system.

By partnering with Snowdrop, you gain access to a reliable, customisable solution built on years of expertise. Our dedicated team handles the complexities for you, so your developers can focus on enhancing your unique value proposition.

One study indicated that 53% of projects cost 189% of their original estimate, leading to the cancellation of 31% of build-it-yourself projects.

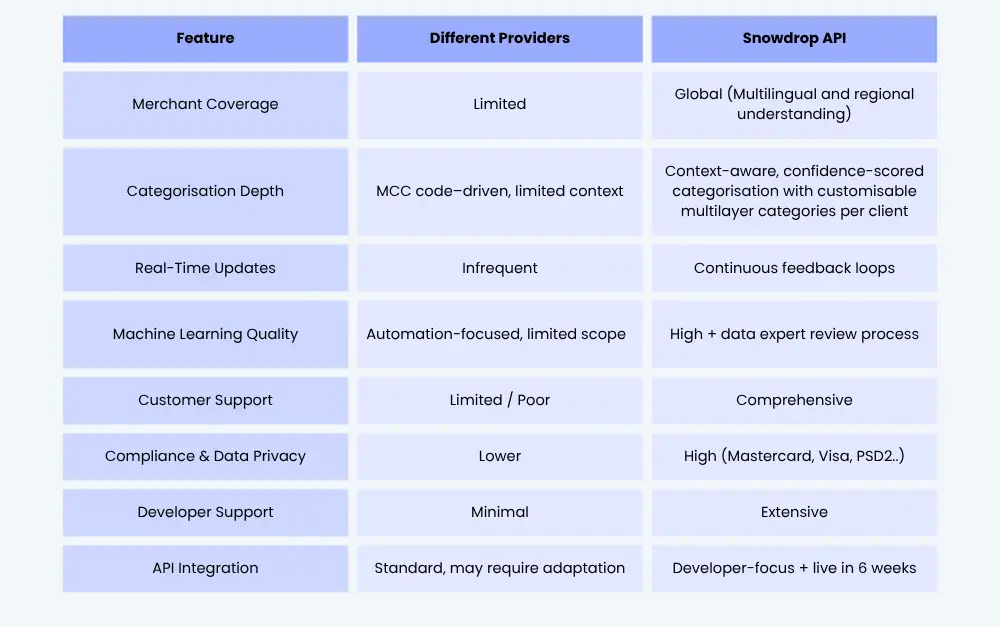

Cheaper solutions won’t solve the problems

Cheaper transaction enrichment providers may save upfront costs, but they often compromise on data quality, reliability, and adaptability; three factors that directly impact the customer experience. Poor enrichment accuracy not only confuses users but also erodes trust in the banking app, leading to higher churn and increased calls to customer service.

Moreover, when enrichment accuracy drops, banks end up paying the price in hidden costs: developer hours spent correcting data issues, delays in app updates, and manual work from customer service teams trying to explain unclear transactions. Over time, these operational inefficiencies often exceed the savings from choosing a cheaper provider.

Another common challenge is scalability and compliance. Cheaper solutions are rarely built to handle complex data requirements across markets, currencies, or languages, and may lack the infrastructure or certifications (such as ISO 27001) required by regulated financial institutions. This can lead to costly re-evaluations when expanding internationally or meeting new compliance standards.

As the table shows, the gap is significant: from global merchant coverage and multilingual understanding to advanced categorisation, continuous feedback loops, and extensive developer support. Choosing a trusted provider ensures not just a higher-quality product but also a partnership built for continuous improvement, compliance, and operational efficiency.

In the end, building or buying a cheaper solution might seem like a cost-saving strategy. But in practice, proven providers deliver greater long-term value by reducing hidden costs, strengthening customer trust, and enabling faster innovation.

Why Snowdrop is the Best Choice for Transaction Enrichment

When selecting a transaction enrichment provider, finding the right partner can make all the difference in delivering exceptional customer experiences and streamlining operations.

With over a decade of experience, a global footprint across 100+ markets, and seamless integration with Google Maps and Cloud, Snowdrop delivers a developer-friendly API trusted by leading banks.

Our solution drives measurable impact: improved accuracy, reduced operational costs, and higher user engagement—backed by dedicated support and continuous innovation.

By transforming raw transaction data into clear, actionable insights, Snowdrop helps organisations strengthen user trust, enhance app experiences, reduce call centre loads, and build lasting customer loyalty.

If you’re ready to take your transaction enrichment strategy to the next level, get in touch with us today. We’d love to show you how Snowdrop Solutions can empower your organisation to succeed in an ever-evolving digital banking landscape.

Marketing & Comms Director

Seasoned Marcomms professional with 8+ years of experience in brand management and digital communications. I thrive on creating impactful content and creative strategies, leveraging location-enhanced data enrichment insights for financial and digital technology companies. In my spare time, I nurture my mind and spirit through creative pursuits and immersive reading.