October 21, 2025

How transaction enrichment boosts banking engagement and customer retention

The financial landscape demands immediate digital adaptation. The cost of inaction is steep: 64% of banks lose customers due to slow digital transformation. Poor customer experience alone costs the financial industry over $10 billion annually.

For too long, banks have focused on selling financial products rather than solving fundamental user problems. However, leading financial institutions and fintechs are gaining a competitive edge with a powerful strategy: using enriched transactional data to better understand customers, deliver smarter solutions, and increase user engagement.

The problem with raw transaction data

Opening a banking app, users typically see cryptic entries like “SQ *JONES CAFE N7” or “POS TESCO 89234B.” This messy data creates three critical problems:

- Friction and Distrust: Customers struggle to recall where they spent their money, leading to confusion and doubt about their accounts.

- Operational Strain: This confusion generates high volumes of calls and chats to contact centers, driving up operational costs and diverting resources from strategic initiatives.

- Increased Churn: When users can’t instantly trust their transaction feed, they become disengaged and more likely to switch providers.

This lack of transparency highlights a fundamental industry shift. Major financial institutions now recognise that transaction enrichment isn’t just “nice to have”, it’s a business imperative that spans user experience, operations, regulatory compliance, and brand trust.

What stands out to us is the persistent gap between what users expect and what most apps deliver. There is a lot of talk around innovation, but often it fails in execution. Small friction points, vague alerts, irrelevant recommendations, all of these add up. And users notice.

Transaction enrichment: a key competitive advantage

Transaction enrichment transforms raw data into clear, standardised information by adding the full merchant name, logo, spending category (such as “Restaurants” or “Transportation”), and geographical location.

This process converts a simple list of transactions into an intuitive, transparent record of spending that drives daily app usage. For banks, transaction enrichment forms the foundation for building stronger, more reliable customer relationships.

How leading banks drive results with transaction enrichment

Several leading banks and fintechs are already realising substantial gains by prioritising data quality.

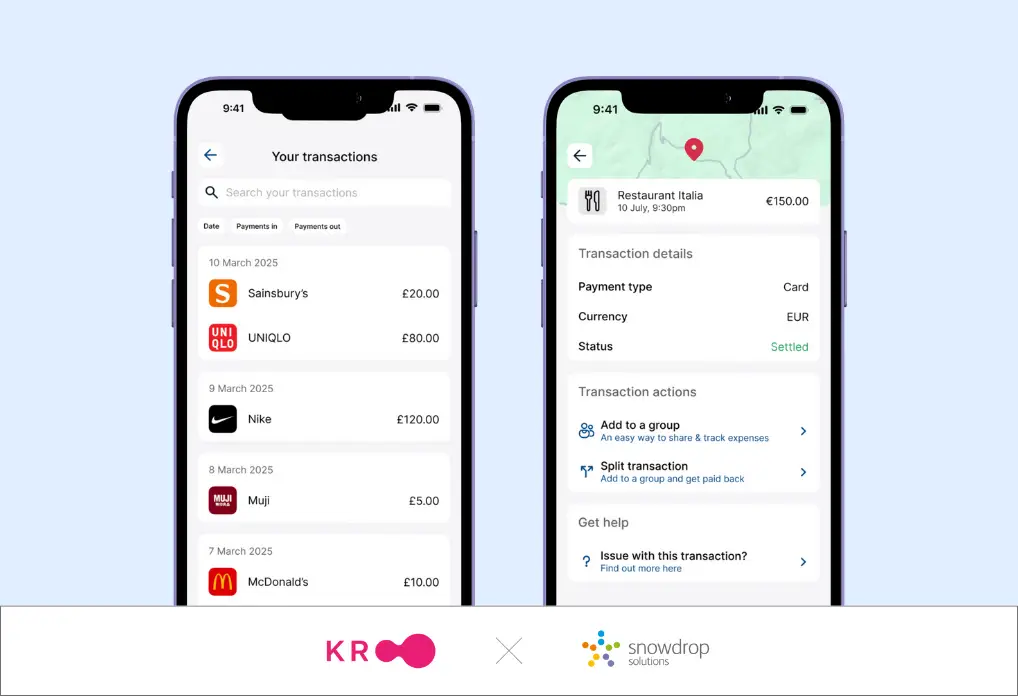

Kroo: Reducing queries and increasing usage

Kroo’s mission centered on creating a more positive, two-way relationship between customers and providers. However, insufficient data quality was generating high customer support queries. Their goal went beyond fixing the problem – they wanted to empower customers and put them in control of their finances by making banking simpler and more enjoyable.

The solution

Integrating Snowdrop’s enrichment API, Kroo provided customers with advanced accuracy, transparency, and comprehensive transaction details. This enriched data equipped users with deeper financial insights, enabling them to identify spending patterns and manage budgets more effectively.

The result

A 15% rise in user engagement and a significant drop in customer support queries, saving both time and costs.

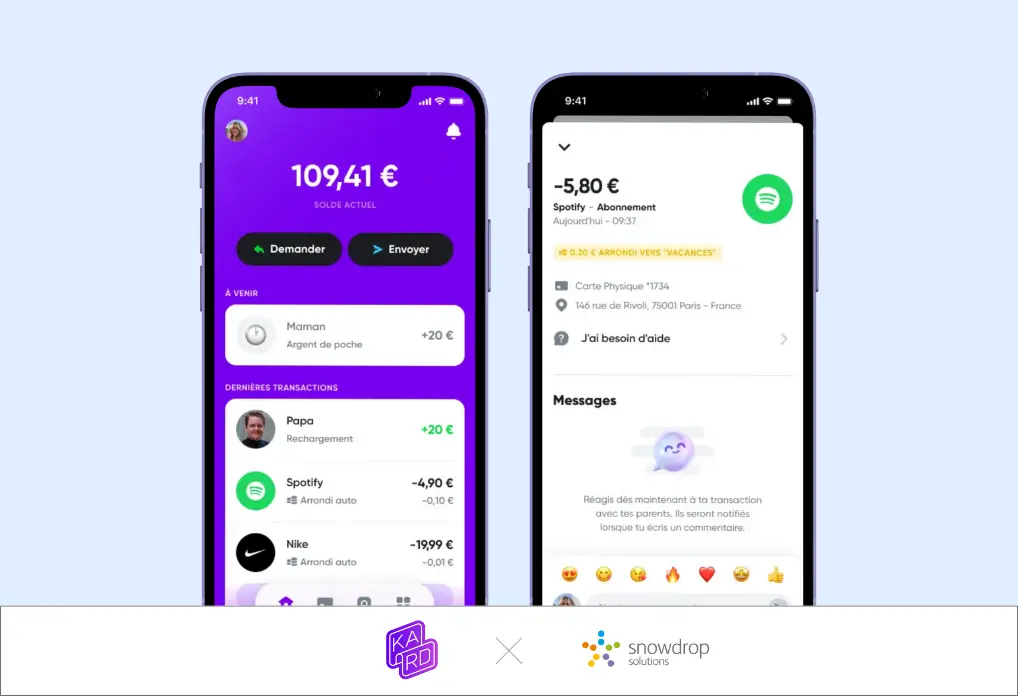

Kard: Solving for accuracy and a critical trust challenge

Kard’s in-house cleaning system could only achieve a 50% cleaning rate, insufficient for the clarity their customers demanded. Their users – teens tracking expenses for better budget management and parents seeking transparency for their children’s financial safety -required a clear, reliable way to identify transactions.

The solution

After a thorough evaluation prioritising fintech expertise, high accuracy rates, and an innovative roadmap, Kard integrated Snowdrop’s transaction enrichment solution powered by Google’s technology.

The result

This integration allowed the clean merchant rate to rise to over 94%, enabling users to easily recognise and understand their spending.

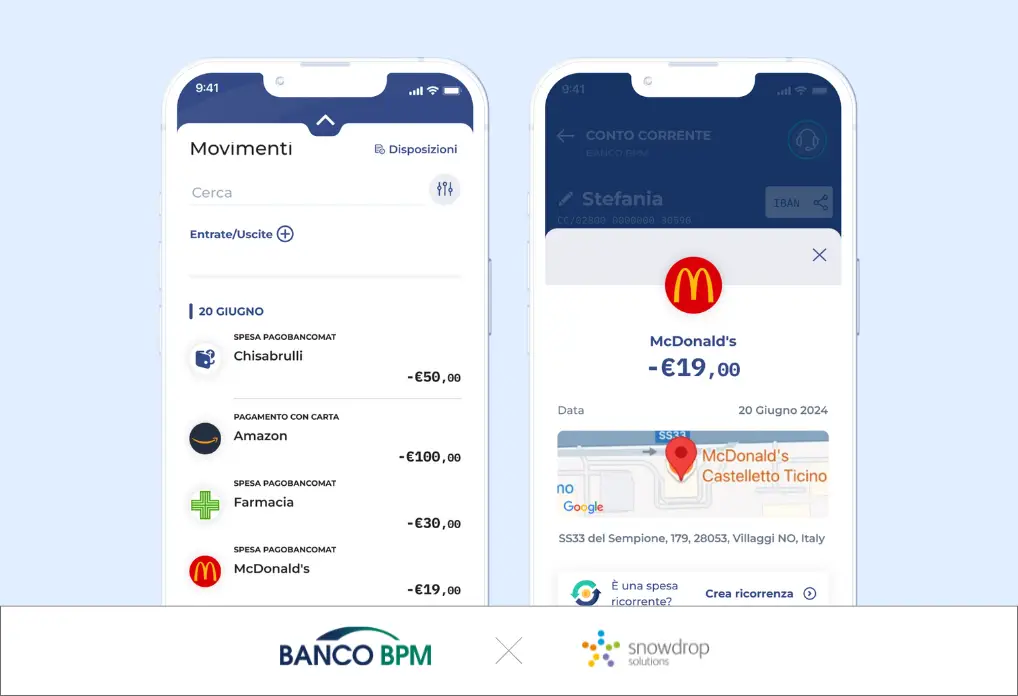

Banco BPM: Accelerating digital innovation

Banco BPM was committed to delivering the best possible digital banking experience with increasingly innovative solutions. The project was part of their broader strategy to achieve market differentiation through an intuitive digital experience, requiring clearer transaction summaries in their mobile app.

The solution

Banco BPM utilised Snowdrop’s enrichment API, leveraging its developer-friendly design principles. Thanks to high scalability and rapid implementation architecture, the bank successfully deployed the solution in under two months.

As a result

This integration, powered by advanced AI, allows users to view detailed information, providing greater clarity and control.

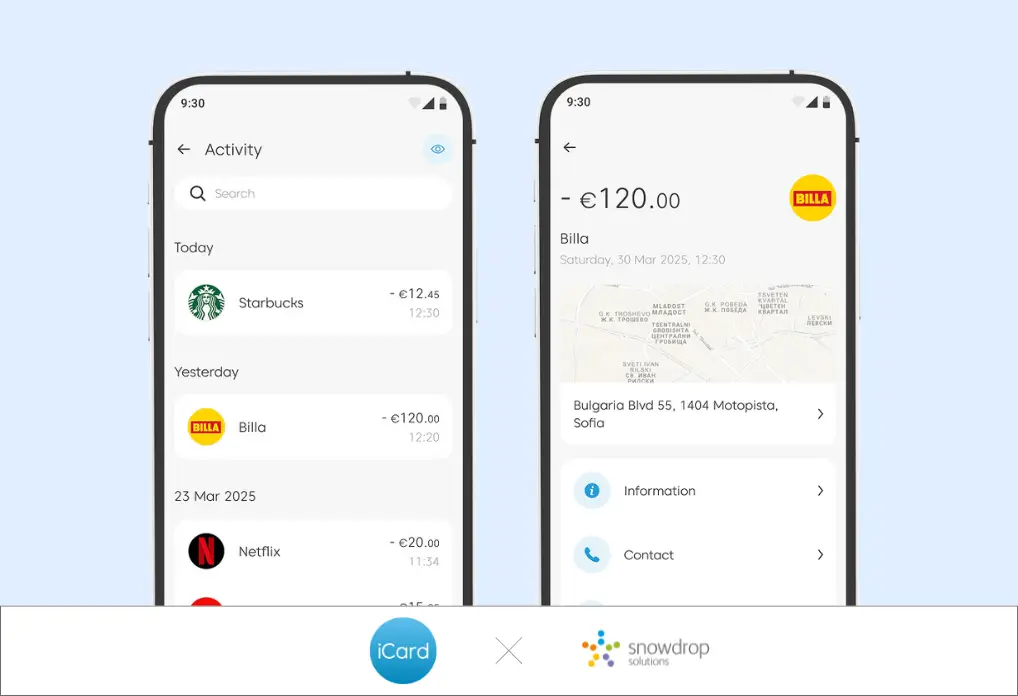

iCard: Driving core app usage

iCard aimed to elevate transparency and control by enhancing the accuracy and contextualisation of transaction data. Insufficient clarity and contextual information at both point-of-sale and online channels was hindering the user experience.

The solution

iCard partnered with Snowdrop Solutions to implement their advanced transaction enrichment solution. By adding merchant logos, commercial names, accurate locations, purchase categories, and additional details such as addresses, working hours, and websites, the API transformed iCard’s app interface.

The result

The enhanced “Recent Activity” list led to a 21% increase in user clicks on detailed transaction information within the first year.

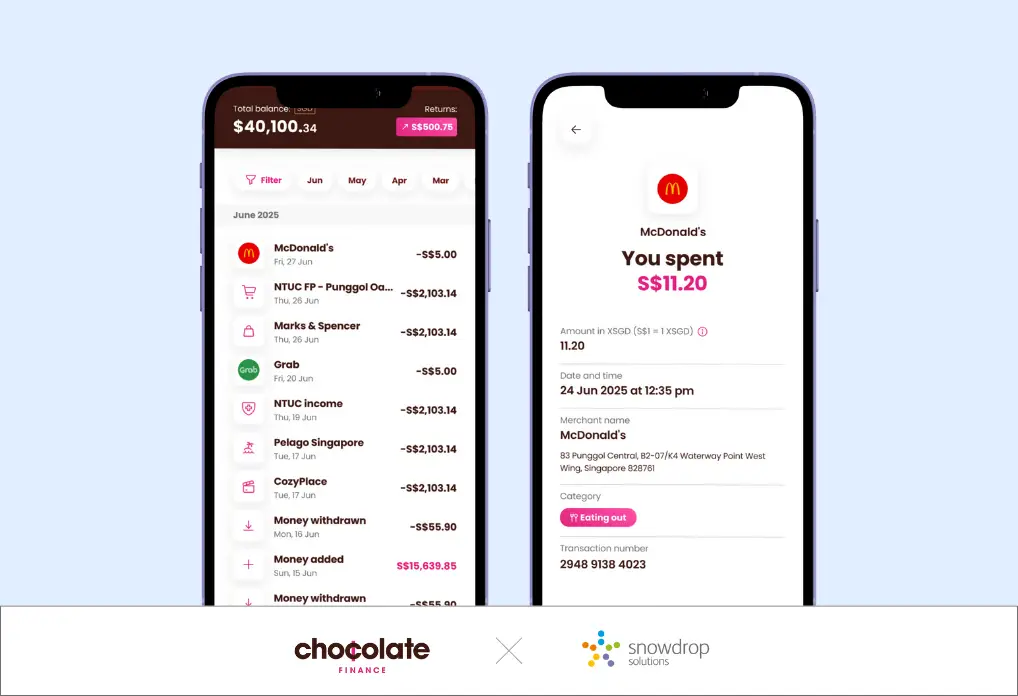

Chocolate: App revamps focused on user-centric clarity

Chocolate Finance recognised that raw transaction data created a significant clarity gap. Their goal is to reimagine money in a way that feels effortless, modern, and intuitive, demanding a best-in-class solution.

The solution

As part of this key upgrade, they implemented Snowdrop’s API to enhance basic transaction data with merchant names, logos, and customised categories, helping users filter through transactions more easily.

As a result

This added context provided better financial insight and built trust in the user experience.

Data quality as the foundation for user engagement

For modern banking, transaction data enrichment has evolved from a niche feature to the foundation of app customer experience. By providing transparency, clarity, and control, banks simultaneously reduce operational costs through fewer contact center queries and significantly boost user engagement.

Higher engagement translates directly into stronger customer retention and new opportunities to offer valuable services like personalised spending insights or targeted cashback offers.

The lesson is unmistakable: solving transactional clarity is the gateway to higher engagement, better retention, and a profitable, enduring relationship with the modern customer.

Head of Digital Marketing

Fintech-focused digital marketer with a passion for travel, hiking, and history. Leading digital strategy and social media for a tech company. Always exploring the latest industry trends.